Ontario’s Minimum Wage Increasing October 1st

" alt="Ontario’s Minimum Wage Increasing October 1st">

" alt="Ontario’s Minimum Wage Increasing October 1st">

Written on behalf of Peter McSherry

The general minimum wage in Ontario is increasing as of Thursday, rising from $14.00/hr. to $14.25. Starting this year, the minimum wage is set to increase annually on October 1st each year. The new minimum rate will be set by the provincial government and published by April 1st of each year. Therefore, the 2021 increase will be made public on or before April 1, 2021. Below, we will provide an overview of the changes to Ontario’s minimum wage in the past several years, as well as the specific changes coming into effect later this week.

Increase Comes After Cancellation of $15.00 Minimum Wage

Under the previous provincial government administration, the minimum wage was raised significantly on January 1, 2018, from $11.60/hr to $14.00. Following that increase, many business owners complained about the 20% hike, reducing employee hours, benefits and/or raising prices in order to compensate for the additional cost.

At the time, the government set another benchmark, promising to raise the minimum by another dollar to $15.00/hr as of January 1, 2019, however, this plan was scrapped following the provincial election in 2018. The current administration ran on a promise to cancel the pending increase, while also eliminating provincial income taxes for anyone earning less than $30,000 per year in order to compensate for the loss of the wage hike. This, despite the fact that an independent study at the time showed that the increase would have been more beneficial to Ontario workers than the potential tax savings.

New Minimum Wage by Category

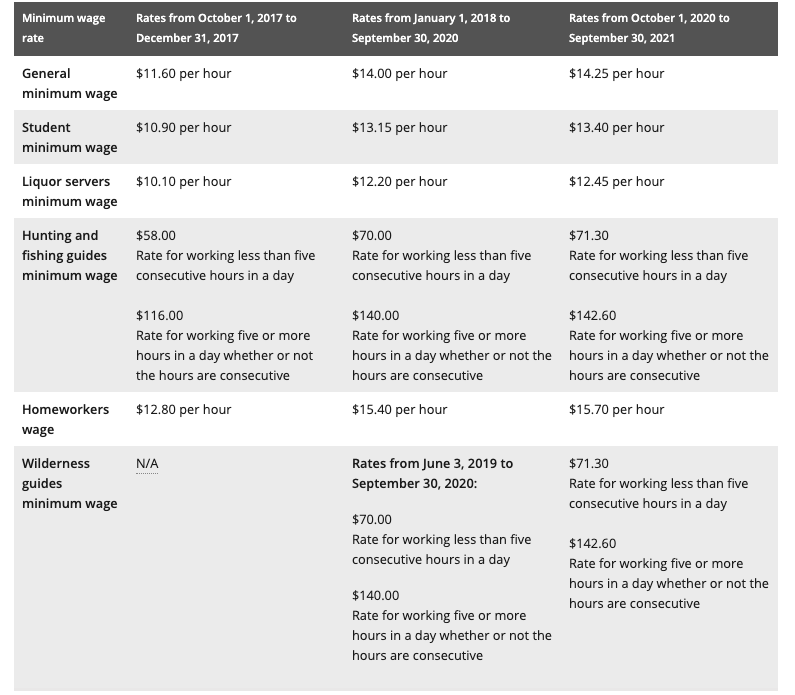

As of October 1st, the minimum wage is set to increase for the first time since the current administration has been in office. However, rather than jumping to $15.00 as intended by the previous government, the rate is only increasing by a quarter, to $14.25. This is the general minimum, however. There are several categories of work with different minimums, as set out in the chart below (reproduced from the Ontario government page on minimum wage):

The general minimum wage applies to most workers in the province, but the various other rates apply in specific circumstances, as follows:

Students are classified as students who are under 18 years of age, working 28 hours or fewer per week during school, or more during a break or summer holidays.

Liquor servers are defined as any employee who serves alcohol to customers, members or guests in an establishment licenced under the Liquor License Act as part of their regular work duties. These employees also must regularly earn gratuities or tips as part of the normal course of their work.

Hunting, fishing and wilderness guides are given unique treatment with respect to the minimum wage. Rather than being paid by the hour, these employees are paid by the total amount of time spent working on a particular day. They earn one wage for working less than five hours, and another if they work five or more hours on a particular day.

Homeworkers are defined as employees who work from their own home, completing work for an employer. The work completed by a homeworker can vary significantly, from sewing clothing to working as a call centre employee.

The Three-Hour Rule

This rule entitles employees who regularly work more than three hours per day, to a minimum daily rate if they are sent home after less than three hours. In this case, the employee is entitled to pay based on whichever is greater:

- three hours of pay at their regular hourly rate, or

- the amount the employee earned during the time they worked, in addition to their regular rate for the remainder of the three-hour period.

This rule does not apply if an employee’s regular shift is less than three hours, or if the employee had to leave work early due to reasons beyond the employer’s control.

If you have questions about your rights as an employee with respect to minimum wage entitlements, contact the offices of Guelph employment lawyer Peter McSherry. We will ensure you understand your obligations and help you determine whether you may have a claim due to a violation of your rights by your employer. Contact us online or by phone at 519-821-5465 to schedule a consultation.